Corporate Governance

- Basic Approach to Corporate Governance

- Improving the Effectiveness of the Board of Directors

- Governance Committee

- Internal Audit

- Officer Compensation

Basic Approach to Corporate Governance

We are committed to meeting the expectations of all our stakeholders through transparent and fair management and the continuous effort to achieve world-class corporate governance.

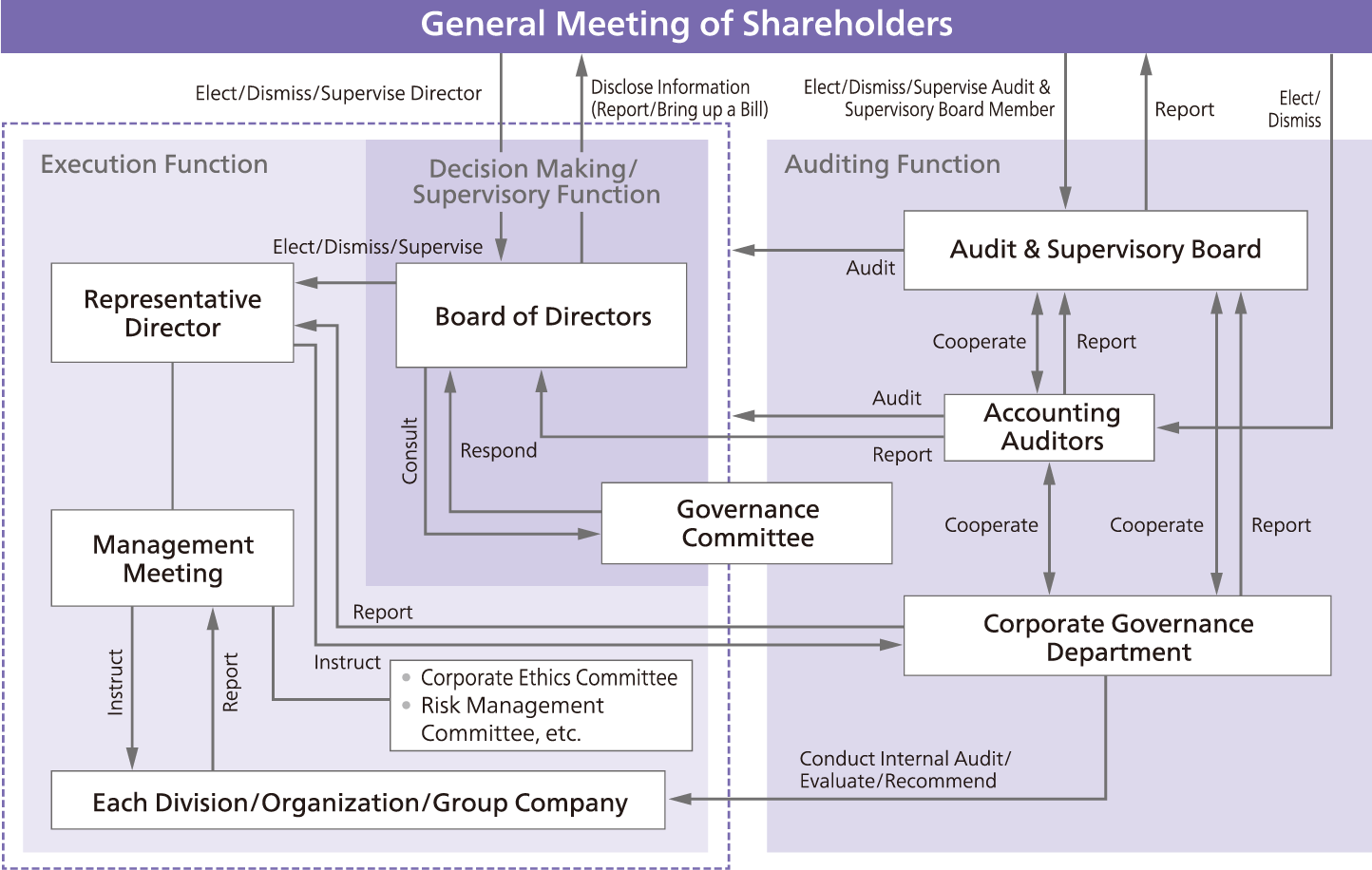

The Audit & Supervisory Board, which includes multiple Outside Audit & Supervisory Board Members, works to ensure the effectiveness of the Company’s governance. This is achieved through audits conducted in active cooperation with the Accounting Auditors and internal audit department as well as the preparation of management strategies and supervision of the executive function by the Board of Directors. Collectively, these initiatives ensure prompt and accurate decisions on business management based on robust discussion. Furthermore, steps are taken to strengthen the governance function by adding independent Outside Directors with extensive experience and management insight.

Corporate Governance System

Role of Each Meeting

| Name | Function | Participants | Main Agenda Items |

|---|---|---|---|

| Board of Directors | To make decisions on important operational matters and conduct statutory reporting as a statutory meeting body | Directors, Audit & Supervisory Board Members |

|

| Governance Committee | As an advisory body to the Board of Directors, provides a wide range of proposals that lead to the Company’s sustainable growth | Outside Directors, Outside Audit & Supervisory Board Members, the Representative Director, the Senior Managing Director |

|

| Audit & Supervisory Board | Audits the execution of duties by the Directors | Standing Audit & Supervisory Board Members, Outside Audit & Supervisory Board Members |

|

| Management Meeting | To discuss and deliberate important management matters and set the direction for company-wide strategies, report on and give approval to important matters in accordance with rules and regulations | Representative Director, Directors with titles, Members appointed by Representative Director |

|

| Division Meetings | To report on and give approval to important business management matters and business execution matters concerning the overall operations of divisions | Executive General Managers of divisions, General Managers, Presidents of domestic and overseas Group companies |

|

| Officers’ Meeting | To discuss medium- to long-term strategic issues | Directors, Audit & Supervisory Board Members, and Executive Officers Operating Officers |

|

| Executive Officers’ Meeting | Executive Officers/Operating Officers discuss items on the Management Meeting agenda and each division issue | Executive Officers Operating Officers |

|

Improving the Effectiveness of the Board of Directors

The Board of Directors, comprising with our key Directors deliberate on important matters with company-wide impact, in order to carefully decide on such matters from multi-faceted viewpoints before consulting with the Board of Directors. We have also adopted an Executive Officer system to separate our “Decision Making/Supervisory Functions” from our “Business Execution Functions.” Moreover, “Operating Officers” have been set up with the aim of strengthening execution functions—each position is in charge of a specialized medium- to long-term strategic topic and vigorously works toward achieving their goals, thus creating a structure that facilitates faster business execution.

Outside Officers are provided with briefings in advance, and discussions at the Board of Directors meetings are based on the feedback and questions raised during the advance briefings, with the aim of improving the quality and efficiency of discussions at the Board of Directors meetings.

Evaluation of Effectiveness of the Board of Directors

The Company evaluates the effectiveness of the Board of Directors (via self-evaluation), with the purpose of validating the efficient and appropriate functioning of the Board of Directors and improving its functions as a whole.

Method of Evaluation

An anonymous questionnaire containing the questions shown on the right is distributed to each Director and Audit & Supervisory Board Member every year. Based on the results of the tabulated responses, the Governance Committee, whose main members are Outside Officers, evaluates the effectiveness of the Board.

Main content of questionnaire

- Composition an size of the Board of Directors

- Operation of the Board of Directors

- Board of Directors’ role, etc.

- Overview

Analysis and Evaluation

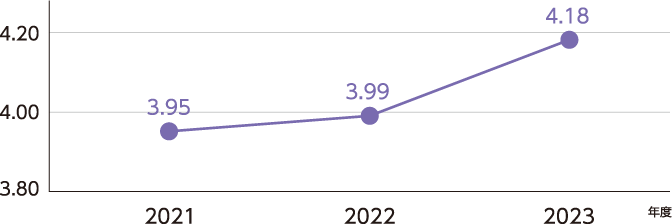

The questionnaire conducted in November 2023 resulted in an average score of 4.18 (+0.19 year-on-year) on a 5-point scale, indicating that the Board of Directors is generally operating effectively. It also revealed that overall, there are no significant differences in evaluation results between internal and external companies.

Feedback from some respondents for free-answer questions indicated that improvements are needed, including the “Succession plans” and “Responses by the Board of Directors for Sustainability.”

| Composition and size | Operation | Role, etc. | Overview | |

|---|---|---|---|---|

| Overall | 4.1 | 4.2 | 4.1 | 4.4 |

| Internal officers | 4.2 | 4.3 | 3.9 | 4.4 |

| Outside officers | 4.0 | 4.1 | 4.2 | 4.5 |

Change in overall average values over the three recent years

-

-

- 5.0 Appropriate/Functioning

- 4.0 Mostly appropriate/Mostly functioning

- 3.0 Ordinary/Neither satisfied nor dissatisfied

- 2.0 Only somewhat appropriate/Only somewhat functioning

- 1.0 Not appropriate/Not functioning

Future Measures

Following the appointment of a female Outside Director in 2022 and a female Outside Audit & Supervisory Board Member in 2023, we are continuing efforts to increase diversity from various angles, including knowledge of the electronics business and global perspectives. Enhancing comprehensiveness of the skills matrix as the Board of Directors serves to bring a variety of opinions presented by a diverse range of members to management, so as to boost corporate value.

We will also expand the scope of discussions on the Succession Plan and addressing sustainability to improve effectiveness.

Governance Committee

Established as an advisory body to the Board of Directors to provide a wide range of proposals that lead to the Company’s sustainable growth, the Governance Committee comprises Outside Directors, Outside Audit & Supervisory Board Members, the Representative Director, and the Senior Managing Director. Chaired by an Outside Director, Governance Committee meetings are generally held on a monthly basis. The Board of Directors decides on each matter after taking into consideration the content of the response by the Governance Committee. In this manner, steps are taken to ensure the independence and objectivity of the functions of the Board of Directors and to strengthen the governance function while improving the Company’s corporate value over the medium to long term.

-

Members (as of June 30, 2025) - Hirokazu Kono (Outside Director, Chair)

- Yozo Takeda (Outside Director)

- Satoko Suzuki (Outside Director)

- Shoji Hatano (Outside Director)

- Mitsuhiro Amitani (Outside Audit & Supervisory Board Member)

- Koichi Uehira (Outside Audit & Supervisory Board Member)

- Eri Yokota (Outside Audit & Supervisory Board Member)

- Yasuaki Kaizumi (President and Representative Director)

- Kazuki Takano (Senior Managing Director)

Internal Audit

Internal Audit Organization, etc

The Company has established the Corporate Governance Department as an internal audit department under the direct control of the Representative Director, comprising 18 staff members, including certified internal auditors. AS a dedicated independent organization, the Corporate Governance Department strives to maintain and improve the soundness of business execution by auditing the Group’s operations as a whole from a wide range of perspectives, including the effectiveness of its internal controls, compliance, etc. The General Manager of the Department attends Audit & Supervisory Board meetings and meetings between the Audit & Supervisory Board Members and the Accounting Auditors. By doing so, the General Manager submits reports and collects information to facilitate mutual collaboration. Furthermore, the General Manager regularly exchanges information with the Standing Audit & Supervisory Board Members.

Mutual Coordination between Internal Audits, Audits by the Audit & Supervisory Board Members, and Accounting Audits, etc

The General Manager of the internal audit department attends the Audit & Supervisory Board meetings held every month to report on audit plans and the results and collects information to facilitate mutual collaboration between the two parties.

The above General Manager also attends meetings with the Audit & Supervisory Board Members and Accounting Auditor, receives reports about the Accounting Auditor’s audit plans, the results of accounting audits during the fiscal year and at fiscal year-end and results of internal control audits, and additionally exchanges information.

If the results of audits by the Audit & Supervisory Board Members, internal audit department, or Accounting Auditor are relevant to the internal control department, they notify the internal control department of the relevant information and mutually coordinate.

Initiatives Designed to Ensure Effectiveness

The internal audit department conducts audits in line with an annual audit plan developed through a risk-based approach and verifies the status of improvements for items requiring attention through follow-up audits conducted at a later date. The results of audits and status of improvements are reported to and discussed among the Representative Director, Directors, and Audit & Supervisory Board Members before being reported to the Board of Directors by the Representative Director.

Officer Compensation

Basic Policy

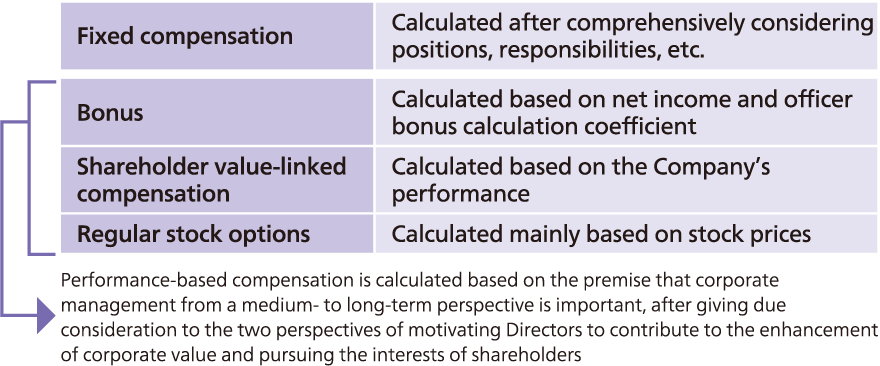

As described below, the policy for compensation, etc. of Directors and Audit & Supervisory Board Members ( “officers”) are determined by the Board of Directors for Directors and by the Audit & Supervisory Board for Audit & Supervisory Board Members, respectively, with the purpose of determining officer compensation, etc. in a fair and appropriate manner, through discussions and responses by the Governance Committee, the optional committee equivalent to the Appointment and Remuneration Advisory Committee.

- The compensation system shall be objective when viewed by stakeholders including shareholders.

- The compensation system shall be partially linked to performance, in order to clarify responsibility for business execution.

- The policy is determined appropriately in light of economic trends, the Company’s business environment, performance, in line with medium- to long-term corporate value, and standards of other companies based on survey data of officers’ compensation conducted by external specialist institutions.

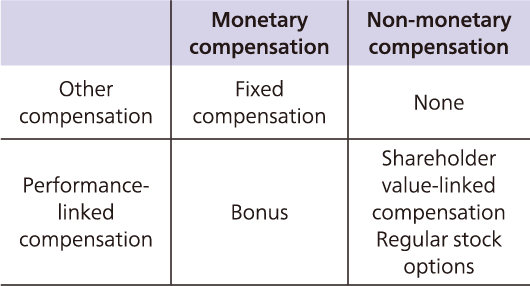

Overview of the Officer Compensation System

Officer Compensation consists of the following elements. It is calculated using a coefficient set for each element of the system.

- Introduce a restricted stock compensation system for Directors (excluding Outside Directors) as shareholder value-linked compensation, with the purpose of increasing their motivation more than ever before to contribute to increasing stock prices, shareholder value, and corporate value.

- Provide share subscription rights as regular stock options to Directors (excluding Outside Directors) and managers free of charge, in order for them to share the risks and rewards of fluctuations in stock prices with shareholders, and to increase their motivation more than ever before to contribute to increasing stock prices, shareholder value, and corporate value.

- Compensation for Outside Directors and Audit & Supervisory Board Members shall only be fixed compensation from the perspective of ensuring independence.

- Regarding the time of payment, fixed compensation will be paid monthly. Other compensation will be paid (allocated) at a certain time.

Officer compensation determination and verification bodies

The Board of Directors will make a resolution to delegate the authority to determine the amount to be allocated to each Director according to the predefined calculation method to the Representative Director. Furthermore, regarding the appropriate exercise of this authority by the Representative Director, we will consult with the Governance Committee and obtain their view for reference.

Total compensation, etc. per officer category (FY2024) *

| Officer category | Number of eligible officers (Persons) |

Total Compensation (Millions of yen) |

Total Compensation by Type (Millions of yen) | ||

|---|---|---|---|---|---|

| Fixed compensation | Bonus | Shareholder value-linked compensation, Regular stock options |

|||

| Directors (excluding Outside Directors) |

7 | 504 | 208 | 220 | 75 |

| Audit & Supervisory Board Members (excluding Outside Members) |

2 | 61 | 61 | - | - |

| Outside Officers | 7 | 60 | 60 | - | - |

- Includes compensation for an Audit & Supervisory Board Member who retired at the conclusion of the 119th Ordinary General Meeting of Shareholders held on June 27, 2024.